Broadly speaking, when it comes to pay stub requirements, there are three types of state: While there is no federal law pertaining to providing pay stubs, most states have their own laws requiring employers to provide access to them. Date of payment and the pay period covered by the payment.All additions to or deductions from the employee’s wages.Total overtime earnings for the workweek.Total daily or weekly straight-time earnings.

Basis on which employee’s wages are paid (e.g., “$9 per hour”, “$440 a week”, “piecework”).Time and day of week when employee’s workweek begins.

Paperless payroll estub full#

Employee’s full name and social security number.Basic records that an employer must maintain include: The FLSA requires this information to be accurate. The Act requires no particular form for the records, but does require that the records include certain identifying information about each employee, as well as data about the hours worked and the wages earned. This may sound restrictive, but the FLSA covers almost 90% of US workplaces.Įvery employer covered by the FLSA must keep certain records for each non-exempt worker. The FLSA applies to employers with annual sales equal to $500,000 or more, or who are engaged in interstate commerce. Who is affected by the Fair Labor Standards Act? These records must be open for inspection by the Department of Labor’s representatives, who may ask the employer to make extensions, computations, or transcriptions. Records on which wage calculations are based (time cards, schedules, records of wage additions/deductions) should be retained for two years. The records may be kept at the place of employment or in a central records office. This includes payroll information, collective bargaining agreements, sales and purchase records. Under the FLSA, employers need to keep records for at least three years. How long do employers need to keep employee information? Because, while the FLSA requires that employers keep accurate records of hours worked and wages paid, this doesn’t mean employees don’t have a right to see their wages information. When it comes to pay stubs, we’re concerned with the record-keeping aspect of this Act. The Fair Labor Standards Act (FLSA) is a federal law which establishes minimum wage, overtime pay eligibility, recordkeeping, and child labor standards affecting full-time and part-time workers in the private sector and in federal, state, and local governments.

But first, we’ll start at the federal level, as these rules apply to all US businesses.įederal Payroll Law What is the Fair Labor Standards Act? This guide will help you identify whether you are operating in an “access state”, an “access/print” state or something altogether different. Beyond that, employers are subject to state legislation and compliance.įor businesses who employ staff across state lines, running the payroll compliantly can be a challenge, due to the various rules and pay stub requirements by state.

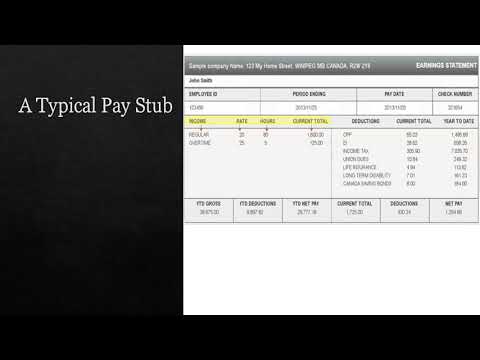

In legislation, pay stub law falls under the Fair Labor Standards Act (FLSA). There is no federal law that requires employers to provide employees with pay stubs. That means ensuring that you are compliant can seem complicated, but as international payroll specialists we are here to guide you through the pay stub laws for 2021. An employer’s obligations surrounding pay stubs will differ from state to state. Pay stubs, or paycheck stubs, are written statements documenting details of the employee’s wages during a set pay period or schedule. Resource Type: Useful Info Understanding pay stubs with IRIS FMP

0 kommentar(er)

0 kommentar(er)